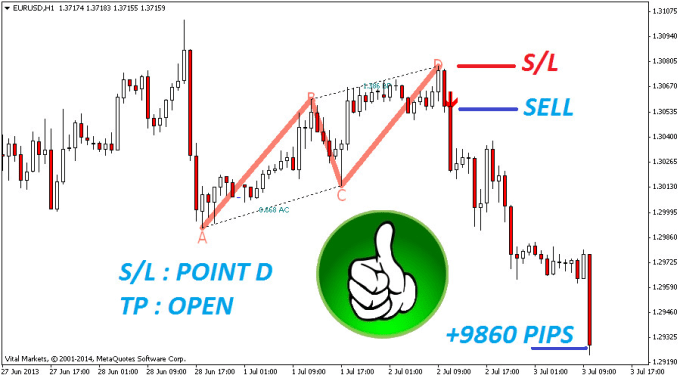

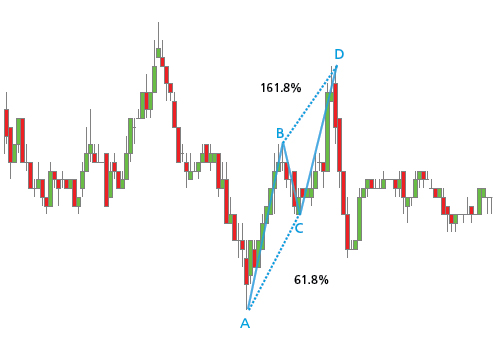

The Fibonacci relationships aid in finding an approximate area (PCZ) where the pattern may complete. A secondary target level is set at 100% AB Level at 152.21. The first target zone is (62-79% AB) from “C” and the second target zone is (127-162% AB). The height pattern (AB) is used to project target levels from C-level using Fibonacci ratios.

The ABC pattern targets are computed using the AB and BC swings. There are various confirmation and trade entry methods, but one of the best methods is when price crosses a 2-bar high after “C” in an ABC bullish pattern or a 2-bar low after “C” in an ABC bearish pattern.Ī “Stop” is placed a few ticks below C (if bullish) or a few ticks above C (if bearish) levels. This PCZ area is where a “C” pivot is formed at the end of a BC swing that signals the completion of an ABC pattern.Īfter an ABC pattern is completed, it is advisable to wait for the pattern to confirm a reversal signal using any momentum-based indicator or price confirmation mechanisms. The ABC bullish structures are formed after a prolonged prior down trend or consolidation trends, whereas bearish ABC patterns are formed after a prior uptrend.Ī PCZ is computed using AB swing and Fibonacci ratios (50-88.6% of AB). The tradable CD leg has a harmonic relation with symmetry for AB and BC swings. The swing legs (AB and BC) in ABC pattern are generally in symmetrical proportions both in price and time with consistent slopes. “Know your ABCs,” below, show both ABC Bullish and ABC Bearish formations with using trade information in TradeStation software. The ABC pattern is traded in the trend direction of AB from C to D. Following the completion of BC leg, the projections of AB and BC legs (using Fibonacci ratios) are plotted (from C) to generate targets. This PCZ area is where ABC pattern is expected to complete and may signal continuation of its trend in the first trend direction (AB). Once A, B and C points (and AB, BC legs) are identified, a projection algorithm is applied to compute the Potential Completion Zone (PCZ). The potential C point is usually forecasted by the fibonacci retracements (0.38 to 0.618) of AB Swing. These inflection points are determined by key swing highs and lows of various levels, and its correction waves to determine distinct swings. The key point in identifying an ABC and AB=CD patterns is to correctly detect the A, B and C key inflection (pivot) points in a chart while they are forming. The ABC pattern can be a continuous or reversal pattern, and it is shaped like a lightning bolt.

ABCD TRADING PATTERN HOW TO

Here, we describe how to trade “ABC” chart patterns. Gartley in his book “Profits in the Stock Market.” The main advantages of trading harmonic patterns are that they allow traders to determine risk versus reward ratios beforehand as they forecast key market turning points and profit targets for traders. The ABC and AB=CD patterns are first described by H.M.

These harmonic patterns help traders to identify buying and selling opportunities in all markets and in all time frames. The ABC chart pattern and its related AB=CD chart pattern are prime examples of symmetry in the markets. Symmetry is visible in all markets and in all time frames. These harmonic price movements produce symmetric rallies and declines to give traders an advantage to determine the key turning points. Many investors/traders use cycles and harmonic relationships to project future swing price/times. Market trends can be defined by geometric relationships as they exhibit harmonic relationships between the price and time swings. Markets demonstrate repetitive patterns where prices oscillate between one set of price ratios and another making price projections possible.

0 kommentar(er)

0 kommentar(er)